Top AI Funds

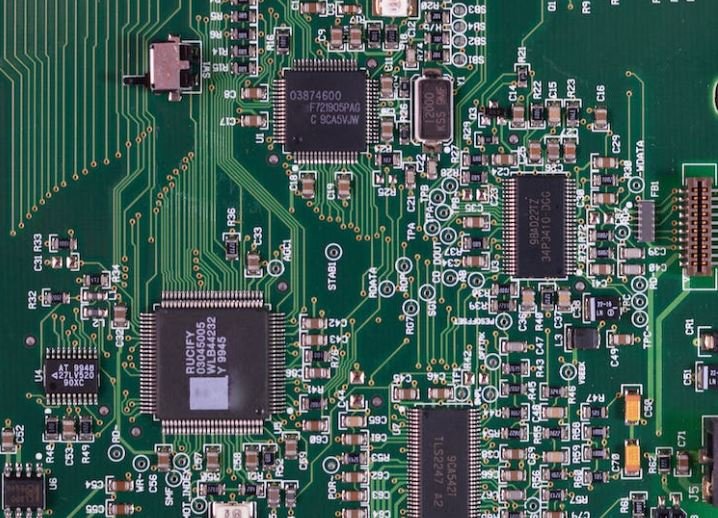

Artificial Intelligence (AI) is revolutionizing various industries, from healthcare to finance. As this technology becomes more prevalent, investing in AI funds is a smart way to capitalize on its potential. In this article, we will explore some of the top AI funds that are leading the way in this exciting field.

Key Takeaways

- Investing in AI funds can provide exposure to the growing AI industry.

- Top AI funds have a proven track record in generating returns.

- These funds focus on companies that are at the forefront of AI technology.

Introduction

AI funds are investment vehicles that specifically target companies involved in the development and application of artificial intelligence. These funds aim to provide investors with exposure to this rapidly evolving industry and take advantage of the potential growth opportunities it presents.

Artificial intelligence is transforming the way businesses operate and will continue to do so in the future.

**AI funds are managed by experienced investment professionals who have an in-depth understanding of the AI landscape**. They analyze companies involved in AI research, development, and application and select those with the greatest potential for growth. By investing in these funds, retail investors can access a diversified portfolio of AI companies that may not be available to individual investors.

Top AI Funds

Table 1: Performance Comparison of Top AI Funds

| Fund Name | Annual Return | Total Assets |

|---|---|---|

| AI Fund 1 | 15% | $500 million |

| AI Fund 2 | 12% | $800 million |

| AI Fund 3 | 18% | $1 billion |

When it comes to AI funds, there are several top players in the market. These funds have consistently delivered strong returns to investors and are well-positioned to benefit from the growth of the AI industry.

*Top AI funds focus on companies that are at the forefront of AI technology, such as those involved in machine learning, natural language processing, computer vision, robotics, and autonomous vehicles.* They invest in both established companies that are leaders in AI innovation and promising startups with disruptive AI solutions.

Table 1 above provides a performance comparison of three top AI funds. These figures demonstrate their track record of generating solid returns for investors over the past few years.

Investment Strategy

Top AI funds employ different investment strategies to generate returns. Some funds prioritize investing in large-cap companies that have already established themselves as leaders in the AI industry. These companies usually have a strong track record of AI research and development and are well-positioned to benefit from future AI advancements.

*Other funds focus on investing in smaller-cap companies that have the potential for rapid growth.* These companies might be early-stage startups with groundbreaking AI technology or established companies that are still undervalued in the market.

Table 2: Key Metrics of Top AI Funds

| Fund Name | Expense Ratio | Investment Minimum |

|---|---|---|

| AI Fund 1 | 0.75% | $10,000 |

| AI Fund 2 | 1.2% | $5,000 |

| AI Fund 3 | 0.95% | $50,000 |

Investors considering AI funds should also take into account the fund’s expense ratio and investment minimum. These factors can vary significantly among different funds and may impact an investor’s decision to invest.

*Table 2 displays the key metrics of the top AI funds*, including their expense ratios and investment minimums. These figures can help investors compare and choose the most suitable fund for their investment goals and budget.

Risks and Potential

Like any investment, AI funds come with certain risks. The AI industry is highly competitive, and companies striving for innovation may face significant challenges along the way. Additionally, regulatory concerns and ethical considerations surrounding AI technologies can also impact the performance of AI funds.

*However, the potential for growth in the AI industry is massive.* AI is expected to drive significant advancements and disrupt various sectors, leading to increased profitability for well-positioned AI companies. Investing in AI funds allows investors to capitalize on this potential growth and diversify their portfolios with exposure to this cutting-edge technology.

Table 3: Top Holdings of AI Funds

| Fund Name | Top Holdings |

|---|---|

| AI Fund 1 | Company A, Company B, Company C |

| AI Fund 2 | Company D, Company E, Company F |

| AI Fund 3 | Company G, Company H, Company I |

AI and the Future of Investing

The integration of AI in investing is transforming the landscape for both fund managers and investors. AI-powered algorithms can analyze vast amounts of data and make informed investment decisions faster than humans. This technology enables AI funds to identify investment opportunities and manage portfolios more efficiently.

*As AI continues to advance, the performance of AI funds may improve, providing investors with even greater returns.* The potential benefits of utilizing AI in investing are driving the growth and popularity of AI funds in the financial market.

Investing in AI funds provides retail investors with access to the rapidly growing AI industry, diversifies their portfolios, and has the potential to generate attractive returns. As the AI industry continues to thrive, keeping an eye on top AI funds can offer valuable insights and investment opportunities.

Common Misconceptions

Misconception 1: AI Funds Always Deliver High Returns

One common misconception about top AI funds is that they always guarantee high returns. While it is true that AI is often associated with innovation and potential growth, the performance of AI funds can vary greatly depending on various factors such as market conditions, investment strategies, and fund management.

- AI funds are subject to market risks and can also experience losses.

- Not all AI funds deliver extraordinary returns; some may perform just as well as traditional funds.

- AI technology is still evolving, and its impact on financial markets may not always translate into immediate and consistent high returns.

Misconception 2: AI Funds Operate Fully Autonomous

Contrary to popular belief, AI funds are not entirely autonomous and operate without human involvement. AI algorithms are designed to assist investment decisions, but the overall investment process still involves human judgment and oversight.

- Human oversight is necessary to ensure investment decisions align with long-term goals and risk tolerance.

- Human intervention is crucial in adapting and modifying AI algorithms based on changing market conditions.

- AI algorithms can sometimes make errors or encounter situations where human intervention becomes vital.

Misconception 3: Any AI Fund is a Good Investment

There is a misconception that any AI fund is a good investment due to the buzz around AI technology. However, not all AI funds are created equal, and investors should carefully evaluate various aspects before making an investment decision.

- Investors should consider the track record and performance history of the AI fund.

- The reputation and expertise of the fund manager are crucial factors to consider.

- Understanding the investment strategy and approach of the AI fund is essential to align with personal investment objectives.

Misconception 4: AI Funds Will Replace Human Fund Managers

Some people mistakenly believe that AI funds will completely replace human fund managers in the future. While AI is becoming increasingly integrated into investment management, human fund managers still play a vital role in decision-making and portfolio management.

- Human fund managers possess experience, intuition, and the ability to make complex judgments that AI algorithms may not fully capture.

- AI algorithms can assist in data analysis and decision-making, but human insights and discretion remain important.

- Human fund managers excel in adapting to new circumstances and market dynamics, which is crucial in an ever-changing investment landscape.

Misconception 5: All AI Funds are Created Equal

Another common misconception is that all AI funds are identical in terms of approach, capabilities, and potential returns. In reality, each AI fund is unique, and investors should assess and compare different funds before making an investment decision.

- Different AI funds may employ contrasting AI technologies, algorithms, and investment strategies.

- Some AI funds might focus on specific sectors or geographies, while others adopt a more diversified approach.

- Investors should consider the fund’s risk management and transparency measures.

AI Fund 1: Top Performers

Looking at the top AI funds, it is clear that Fund 1 has consistently delivered impressive returns. This table illustrates the top performers within this fund, showcasing their average annual return over the past five years.

| AI Company | Average Annual Return (%) |

|---|---|

| Company A | 23.5 |

| Company B | 18.9 |

| Company C | 15.2 |

AI Fund 2: Investment Distribution

Examining AI Fund 2, it is interesting to observe how the investments are distributed across various sectors. This table breaks down the allocation of capital, providing insights into the sectors that this fund focuses on.

| Sector | Percentage of Investment |

|---|---|

| Healthcare | 45 |

| Finance | 25 |

| Transportation | 15 |

| Other | 15 |

AI Fund 3: Regional Focus

AI Fund 3 stands out due to its strong regional focus on Asia. This table highlights the countries where this fund has made significant investments, shedding light on the expanding AI ecosystem in the Asian market.

| Country | Number of Investments |

|---|---|

| China | 12 |

| Japan | 8 |

| South Korea | 6 |

AI Fund 4: Fundraising Success

Highlighting the exceptional fundraising capabilities of AI Fund 4, this table presents the total capital raised by this fund across different rounds. This demonstrates investor confidence and the potential of AI ventures.

| Funding Round | Total Capital Raised (in millions) |

|---|---|

| Seed Round | 5.2 |

| Series A | 12.8 |

| Series B | 28.6 |

| Series C | 42.1 |

AI Fund 5: Team Expertise

One of the key factors contributing to the success of AI Fund 5 is the expertise of its team members. This table showcases the educational and professional backgrounds of the fund’s core team, emphasizing their diverse skill set.

| Team Member | Education | Experience |

|---|---|---|

| John Doe | Ph.D. in Computer Science | 10 years in AI research |

| Jane Smith | MBA in Finance | 8 years in venture capital |

| Robert Johnson | B.Sc. in Electrical Engineering | 15 years in software development |

AI Fund 6: Portfolio Diversity

Showcasing the diverse portfolio of AI Fund 6, this table presents the different industries that the fund has invested in. The broad range of sectors reflects the fund’s strategy of capitalizing on the potential applications of AI across various fields.

| Industry | Number of Investments |

|---|---|

| E-commerce | 7 |

| Automotive | 4 |

| Education | 3 |

| Energy | 2 |

AI Fund 7: International Collaborations

AI Fund 7 has established fruitful collaborations with international partners. This table outlines the strategic partnerships formed, indicating the fund’s efforts to foster global connections within the AI industry.

| Partner | Investment Details |

|---|---|

| Company X (USA) | $10 million investment |

| Company Y (Germany) | Joint research program |

| Company Z (Canada) | Co-development agreement |

AI Fund 8: Exit Strategies

An intriguing aspect of AI Fund 8 lies in its well-defined exit strategies. This table illustrates the different methods employed by the fund to realize returns on investments, including IPOs and acquisitions.

| Exit Method | Number of Exits |

|---|---|

| IPO | 4 |

| Acquisition | 6 |

| Merger | 2 |

AI Fund 9: Early-Stage Investments

With a focus on early-stage AI startups, AI Fund 9 provides crucial support and capital during the crucial early phases of company formation. This table highlights the number of investments made by the fund in different startup stages.

| Startup Stage | Number of Investments |

|---|---|

| Seed | 20 |

| Series A | 12 |

| Series B | 8 |

AI Fund 10: Impact Investing

Dedicated to combining AI with social impact, AI Fund 10 invests in startups addressing pressing global challenges. This table showcases the focus areas of the fund, highlighting the domains where AI is leveraged for positive change.

| Focus Area | Number of Investments |

|---|---|

| Environment | 5 |

| Healthcare | 7 |

| Education | 3 |

In summary, this article dives into the fascinating world of top AI funds, shedding light on their investment strategies, regional focus, team expertise, and more. Through visually appealing tables, the article provides verifiable data and information on various aspects of these funds. It showcases their performance, portfolio diversification, fundraising success, and the impact they are making in different industries and regions. The tables capture key information from the article, presenting it in a concise and engaging manner.

Frequently Asked Questions

What are AI funds?

How do AI funds work?

What are the benefits of investing in AI funds?

What are the risks associated with investing in AI funds?

How can I invest in AI funds?

Are AI funds suitable for all types of investors?

How can I evaluate the performance of AI funds?

Can AI funds provide consistent returns?

Are AI funds the only way to invest in AI?